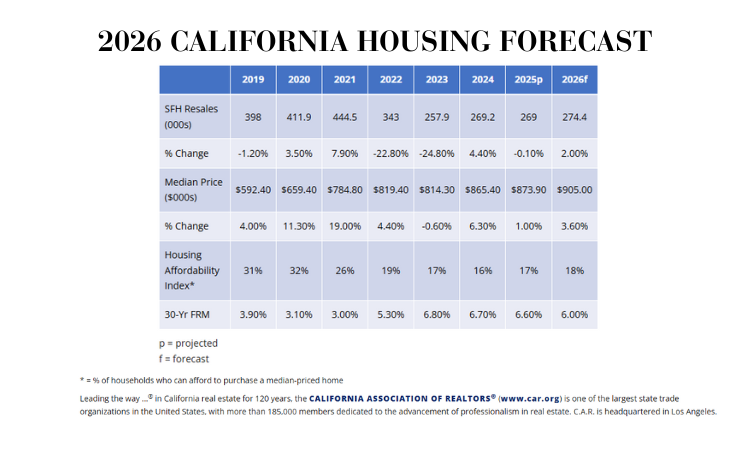

C.A.R. Forecasts Brighter Days Ahead for California’s Housing Market

California home sales and median price are projected to inch up as housing affordability improves slightly.

- Existing, single-family home sales are forecast to total 274,400 units in 2026, an increase of 2 percent from 2025’s projected sales pace of 269,000.

- California’s median home price is forecast to rise 3.6 percent to $905,000 in 2026, following a projected 1.0 percent increase to $873,900 in 2025 from 2024’s $865,400.

- Housing affordability* is expected to inch up to 18 percent next year after edging up to a projected 17 percent in 2025 from 16 percent in 2024.

LOS ANGELES (Sept. 17) – Following an essentially flat housing market in 2025, California home sales are forecast to inch up in 2026, with the median home price expected to reach a new projected record of $905,000, according to a housing and economic forecast released today by the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.).

The baseline scenario of C.A.R.’s “2026 California Housing Market Forecast” sees an increase in existing single-family home sales of 2 percent next year to reach 274,400 units, up from the projected 2025 annual sales figure of 269,000. The projected 2025 figure is 0.1 percent lower compared with the pace of 269,200 homes sold in 2024.

The California median home price is forecast to rise 3.6 percent to $905,000 in 2026, following a projected 1 percent increase to $873,900 in 2025 from $865,400 in 2024. Despite softening home prices in recent months, lower interest rates and a slightly improved housing affordability environment will give room for prices to move up in the coming year.

“Home prices in California are expected to rise in 2026, but the growth pace will remain mild when compared to rates we’ve seen in past years,” said C.A.R. President Heather Ozur, a Palm Springs REALTOR®. “For would-be buyers who sat out the competitive market during the past couple of years, that means more opportunities as inventory increases moderately and lending conditions become more favorable. Seller confidence will also improve as home prices stabilize and demand begins to rise again next year after a slow 2025.”

C.A.R.’s 2026 forecast predicts U.S. gross domestic product (GDP) growth rate to slow 1 percent in 2026, after a projected increase of 1.3 percent in 2025. With California’s 2026 nonfarm job growth rising by 0.3 percent after climbing a projected 0.4 percent in 2025, the state’s unemployment rate will increase to 5.8 percent in 2026 from 2025’s projected rate of 5.6 percent and 5.3 percent in 2024.

Inflation will likely pick up in the next 12 months, but the annual average Consumer Price Index (CPI) for 2025 will dip slightly to 2.8 percent, before bouncing back up to an average of 3.0 percent next year. The average 30-year, fixed mortgage interest rate will moderate slightly to 6.6 percent in 2025 but will decline more solidly to 6.0 percent in 2026. While next year’s projected average for the 30-year fixed mortgage interest rate will still be higher than the levels observed in the few years prior to the pandemic, it will be lower than the long-run average of nearly 8% in the past 50 years.

Housing supply in 2026 will continue to improve and will remain near pre-pandemic levels, with active listings up nearly 10% as market conditions and the lending environment continue to improve.

“As economic uncertainty begins to clear up in the next 12 months and mortgage rates start declining more consistently in the upcoming quarters, housing sentiment will see some improvement in 2026,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “However, mounting headwinds such as the ongoing trade tensions between the U.S. and its trading partners, the home insurance crisis, and a potential stock market bubble will remain challenges for the housing market in upcoming year,” Levine continued.

*Source: C.A.R. releases its 2026 California Housing Market Forecast