Mortgage Rate Stability Brings Strategic Opportunity for Luxury Buyers

Mortgage Rate Stability Brings Strategic Opportunity for Luxury Buyers

Over the past several years, elevated home prices and rising interest rates have made affordability a hot-button issue—even in the luxury market. But recent months have brought a welcome shift: mortgage rates are showing signs of sustained stability. And for discerning buyers and investors, that opens a window for confident, strategic decision-making.

Luxury Buyers Benefit from Rate Stability

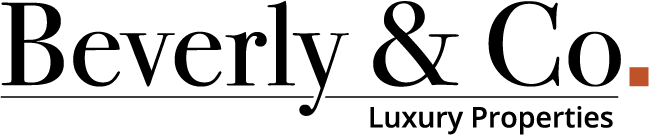

After months of volatility, mortgage rates have settled into a more consistent range. Though still elevated compared to historic lows, they’ve hovered within a half-point band since late last year—a notable departure from the dramatic fluctuations that previously characterized the market.

As HousingWire puts it, this has become “one of the most calm periods for mortgage rates in recent memory.”

For luxury buyers—who often leverage financing to preserve liquidity or for tax strategies—this steadiness makes a difference. Predictable rates mean more reliable monthly projections, easier long-term planning, and renewed confidence in timing high-end purchases.

Why This Matters in the High-End Market

Rate volatility breeds hesitation. When the cost of borrowing shifts week to week, buyers—even affluent ones—tend to pause. But today’s more stable environment allows your clients to evaluate opportunities without the fear of sudden, unexpected financing costs.

As agents, this is a valuable moment to engage serious buyers who may have been sitting on the sidelines. The clarity around mortgage performance makes it easier to advise clients on timing their next acquisition—especially when combined with softening price growth and improving inventory levels in many luxury segments.

Over the past few years, affordability has been the biggest challenge for homebuyers. Between rapidly rising home prices and higher mortgage rates, many have felt stuck between a rock and a hard place.

But, something pretty encouraging is happening. While affordability is still tight, mortgage rates have shown signs of stabilizing in recent months. And that may finally make it a bit easier to plan your move.

As the graph shows, rates have stayed within that half-percentage-point since late last year. Yes, there’s been movement within that range, but wild swings and sudden ups and downs just haven’t been the story lately.

Will Rates Drop Further? Possibly—but Slowly

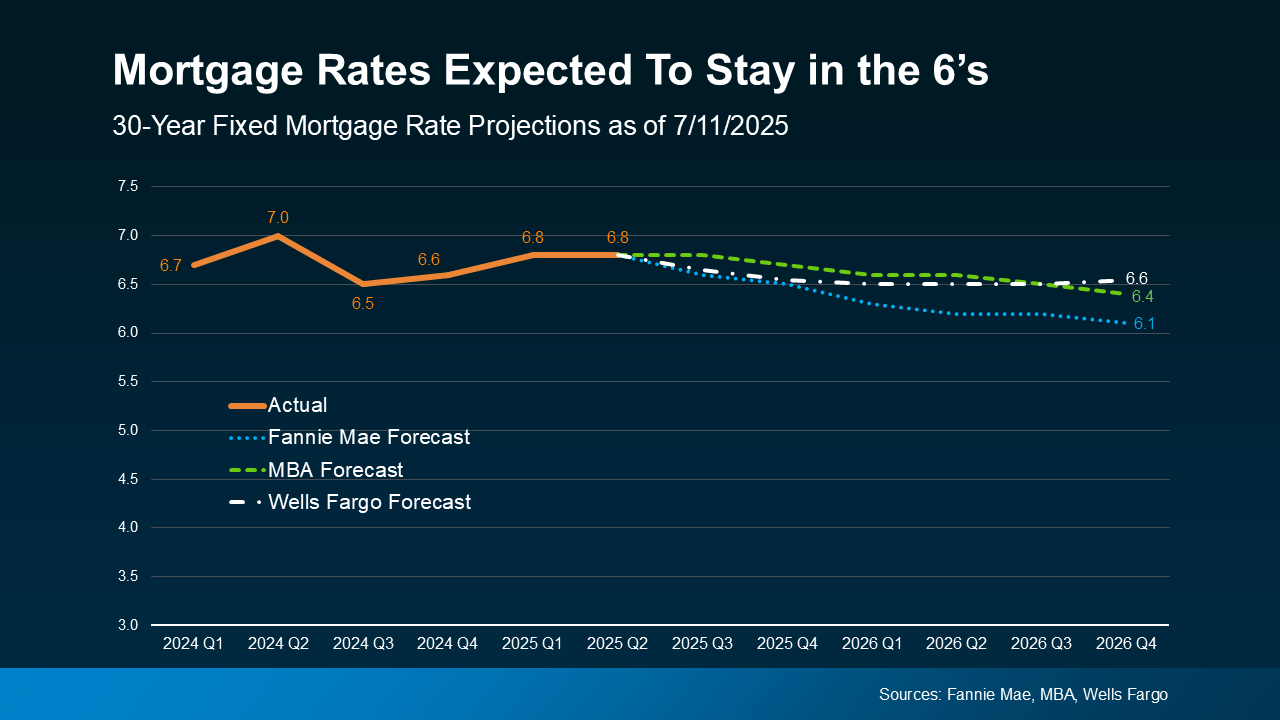

According to economists, we may see modest downward movement ahead, but no dramatic shifts. Danielle Hale, Chief Economist at Realtor.com, notes:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

So for high-net-worth clients waiting for a “perfect” rate—remind them that the difference between today and six months from now might be negligible. Jeff Ostrowski of Bankrate reinforces:

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

Even long-range forecasts suggest we’ll stay near the mid-6% range through the end of 2026, making now a smart time to act while others are still waiting.

What This Means for Your Clients

With rates steady, inventory improving, and luxury price growth slowing, the high-end market is entering a more balanced, strategic phase. As Freddie Mac’s Chief Economist Sam Khater puts it:

“Rate stability, improving inventory and slower house price growth are an encouraging combination.”

This environment empowers you to guide your clients into making confident, well-timed moves in an otherwise complex market.

Bottom Line for Agents

While affordability remains a factor, today’s relative mortgage rate stability offers your luxury clients a chance to plan—and act—with greater certainty. Now is the time to reach out, run the numbers, and help them seize the opportunity before the market shifts again.